Knowledge Park

PRICING

| A/c opening charges (including GST) | Nil |

| Equity/Commodity delivery | 0.30% |

| Equity intraday, equity derivatives, currency derivatives and commodity | 0.03% |

| Equity/Commodity options | Rs. 40 per lot |

| Currency options | Rs. 20 per lot |

| Demat AMC | First Year Free. Rs. 400/- per annum from Second Year Onwards. |

| Delayed payment charges | 0.1% per day |

ACCOUNT OPENING AND ACTIVATION

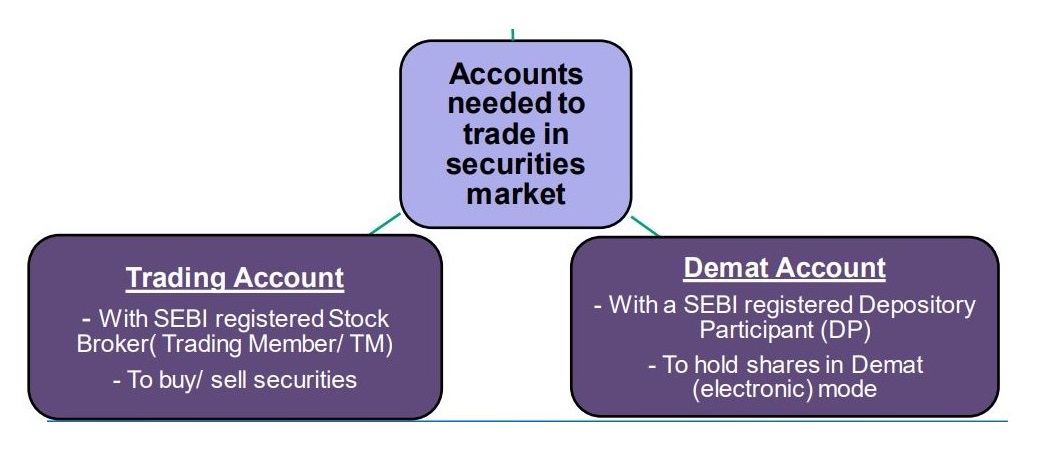

- Demat account

- Trading Account

- Equity

- Derivatives

- Currency

- Commodity

- Resident Individuals

- NRIs

- Minors (Only Demat account. As sole holder)/

- Corporate

- Partnership firms (Demat account in the name of the Partners)

- Registered/Unregistered trust (Demat account. In the name of the Trustees)

- Registered/Unregistered society (Demat account. In the name of the Members)

- Association of Persons (AOP)

- FII/FPI (Only Trading Account)

- Bank

- Mutual funds

- LLP (Limited Liability Partnership)

- Proof of Identity (PAN with photograph mandatory)

- Proof of Address (Passport/ Voters Identity Card/ Ration Card/ Registered Lease or Sale Agreement of Residence/ Driving License/ Flat Maintenance bill/ Insurance Copy /Aadhaar Letter issued by Unique Identification Authority of India./ Telephone Bill (only land line)/ Electricity bill/

- Gas bill/Bank Account Statement/Passbook – (Not more than 3 months old – as on date of receipt for documents).

- Proof of Bank account

- Income Poof (Mandatory incase of derivatives/Currency Segment )

- HUF PAN copy

- HUF address proof

- HUF bank proof

- Karta's PAN card copy (individual with photo visible)

- Karta's address proof

- No Objection Certificate from all Co-Parceners, along with list of Co-Parceners

- Details of Family member and PAN no of co-parceners.

- Partnership firm can open trading account in the name of the firm but demat will be in the name of partners. (Max. 3 partners)

- PAN card of Partnership firm

- Address proof of Partnership firm

- Bank proof of Partnership firm

- PAN card copy along with address proof for all authorized partners is mandatory

- Declaration required (for determining who will be authorized person for trading & who will be the holder in the Demat account) duly signed by all partners

- Declaration to be given by partners on letter head of the firm as per the NSDL guideline (circular uploaded on 4th July, 2013)

- List of partners required on letter head of firm

- Profit sharing certificate required with percentage on letter head of firm

- Copy of Partnership Deed required

- Last 2 years' Annual Accounts (audited Balance sheet) (C.A. Certified)

- Firm's stamp required on all places where signatures are done on trading/ demat account agreement form and all related documents

- Registration certificate required

- Two types - NRE and NRO

- India address proof (not required in case of NRE)

- Foreign address proof (Mandatory both cases)

- PIS Letter (issued by RBI)

- PAN card

- Bank Account Statement/ Passbook Bank proof should indicate NRE/NRO saving a/c bank details

- If NRE or NRO is not mentioned (pre printed) on cheque, then bank verification letter is required.

- All the photocopy of the KYC document should be attested by the any of the entities: Notary Public, any Court, magistrate, judge, Local banker, Indian embassy, Consulate General of the country where NRI is residing.

- Only Demat account of Minor can be opened. Trading account of Minor cannot be opened. Minor shall be the Sole Holder.ie. No joint holder or nominee account can be opened. Minor Account to be operated by Guardian only.

- PAN card copy of Minor

- Birth certificate of Minor

- PAN card copy of guardian where photo is visible

- Bank proof of Minor

- Address proof of guardian

- Father or mother can only be a guardian. In case the guardian is other than a parent, then he has to be appointed by the Court. In case father is deceased, the death certificate is required

- Guardian has to sign in full AOF including across the photograph of the minor applicant.

- Note: - Later on when Minor turns Major need new KYC with proper details of the account holder (Originally who was minor) with all relevant and latest documents. In such cases guardian details can be removed and he can appoint nominee if required.

- PAN Card copy of the corporate

- Bank proof of the corporate

- Address proof of the corporate

- Last 2 year's annual reports & income tax returns

- Memorandum & Articles of Association

- Board Resolution as per the Specific Format.

- List of Authorized Signatory.

- Copy of latest share holding pattern of the Company

- Form no 32 (If changes in directors)

- List of Directors (name & signature) with their shareholding

- Stamp of the corporate required on all the signatures as well as the supporting documents

- PAN copy of all the directors

- Certified copy of the Board resolution (As per the format given in form and it should be on letter head of the Company)

- Undertaking letter is required if company is involved in share broking business or any investment made in broking business

- For Foreign entities, CIN is optional; and in the absence of DIN no. for the directors, their passport copy should be given

- Format of declaration of beneficial owners

- PAN card copy of the Trust

- Last 2 years’ audited annual accounts

- Copy of Income tax return

- Certified copy of the Trust-Deed

- List of trustees with signatures across their photograph as well as

- Trust stamp

- Board Resolution

- Trust Stamp required on all the signatures as well as the Supporting documents

- PAN proof along with address proof of trustees

- Copy of Trust registration certificate<

- Proof of address of registered office of Trust

- List of Authorized trustees along with specimen signatures

You can give a missed call on 01143070700 (30 Lines) and you will get a call from RM and he will assist you in account opening.

Your RM will contact you in case if there is any rejection.

You will receive welcome SMS on your registered mobile number, welcome email on the registered email id and welcome letter along with welcome kit on the registered address.

You will also receive the password on your registered mobile number.

In case you do not receive the welcome letter along with welcome kit and the same is returned to us and your account will be freezed.

You can call on 011-43070700 to unfreeze the account.

Please click here for our exciting brokerage plans

- To trade in the Derivatives segment, you have to submit the F&O Activation in Trading account form. Click here to download the form.

- Following documents (any one) is required to be submitted along with the form:

- Bank Account Statement for last 3 months

- Copy of Demat account holding statement

- Copy of Form 16

- Salary Slip of latest month

- Copy of ITR acknowledgement

- Copy of Annual Accounts

- Net worth Certificate

Procedure for KYC and Account Opening

A new investor has to register with a Stock Broker through whom the trades are executed on the Exchange.

The investor needs to fill two forms for Opening of Trading & Demat Account :

To provide basic information of the new investor. Two modes for KYC are :

- Physical KYC

- e-KYC (online KYC)

Documents requirements for Trading/Demat Accounts:

- Permanent Account Number

- Voter ID Card

- Driving License

- Passport

- Aadhaar Card

- Any other valid identity card issued by Central or State Government

- Voter ID Card

- Driving License

- Passport - Ration Card

- Aadhaar Card

- Narega Card

- Bank account statement for last 6 months

- Latest Salary Slips/ Form 16 in case of salaried person

- Copy of ITR Acknowledgement

- Copy of Net-worth Certificate issued by a Chartered Accountant

- Statement of Demat holdings

- Cancelled Cheque (with name of investor above sign here section)

- Bank Passbook {with Indian Financial System Code (IFSC)} containing 2 months old transactions.

Identity & Address proof must be self-attested and also provide original for verification.

- Rights & Obligations of Stock Broker and Investor.

- Uniform Risk Disclosure Documents.

- Do’s and Don’ts for trading on Exchanges.

- Policies and Procedures of Stock Broker.

- Tariff Sheet.

- Running Account Authorization.

- DDPI

- Electronic Contract Note (ECN) Declaration.

- Consent for electronic communication and receiving alerts (Email/ SMS).

Identity & Address proof must be self-attested and also provide original for verification.

- Compulsory for opening trading/ demat account.

- It can be done through physical verification/ online verification using webcam at the Stock Broker’s office.

- In case of e-KYC, Video In Person Verification (VIPV) for Individuals is also available.

- KYC of the investor is completed using the Aadhaar authentication/ verification of UIDAI.

- KYC form has been submitted online, documents have been provided through DigiLocker or any other source which could be verified online.

- Fill the account opening details/ form online in the Stock Broker’s website.

- Submit scanned images of the mandatory documents/ POA (Proof of address) / POI(Proof of Identity) or through DIGILOCKER.

- Complete IPV (In Person Verification) process

- Digitally Sign the document.

- Account gets activated.

- Visit Website/ App/ Digital platform of Stock Broker

- Fill online KYC Form

- Submit documents online as photograph/ scan of original documents, under e-Sign

- Mobile and Email through One Time Password (OTP)

- Aadhaar à through UIDAI’s authentication/ verification mechanism

- PAN à through Income Tax Database

- Bank account details à by initiating small transfer (usually Re.1/-) which would provide details on name of account holder, bank and IFSC code, also called Penny Drop Mechanism.

- Documents other than Aadhaar à through Digilocker/ e-Sign mechanism

FUNDS PAYIN

- You need to transfer from the bank account which is linked with SFPL

- Login to your bank link enabled for online transfer via NEFT

- Beneficiary Name: STAR FINVEST PVT LTD

- In the Beneficiary account number field enter the details

- For Equity, Derivative and Mutual FundsSegment: -00030340003204

- Beneficiary Account type: Current Account.

- Beneficiary Bank name: HDFC Bank Ltd

- Beneficiary Bank and Branch Name: -HDFC BANK 209-214 KAILASH BUILDING, 26 KASTURBA GANDHI MARG, NEW DELHI

- IFSC code: HDFC0000003

- Amount Transfer

- For Commodity Segment:- Beneficiary Account type: Current Account.57500000156572

- Beneficiary Bank name: HDFC Bank Ltd

- Beneficiary Bank and Branch Name: -HDFC BANK 209-214 KAILASH BUILDING, 26 KASTURBA GANDHI MARG, NEW DELHI

- IFSC code: HDFC0000003

- Amount Transfer

- You need to give cheque from the bank account which is linked with SFPL

- You need to mention the login id on the back side of the cheque

- You need to draw cheque in the name of 'Star FinvestPvt Limited'

- You cannot give Third-party cheques.

- You need to prepare DD from the bank account which is linked with SFPL

- DD/ Pay order should be in the name of STAR FINVEST PVT Limited along with the 8 digits login id printed on it

- DD/ Pay order should be accompanied by a bank confirmation letter.

FUNDS PAYOUT

- Select the Fund Pay mode as, "Cheque through HDFC Bank"

- Select Bank details from the list of banks mapped to your account where you want this cheque to be encashed

- Payout should be due as per exchange settlement norms

- There should be clear credit in your account

- Minimum balance of Rs.1000/- should be maintained

- Fund transfer should be of more than Rs. 999/-

- It takes a minimum of 24 hours for the amount to get transferred.

BSDA

Most of us who don’t invest regularly in stocks, bonds, gold ETFs, IPO, etc may find maintaining our demat accounts a pain because of the charges. The costs, such as annual maintenance and statement charges, make these accounts relatively expensive.

But with the introduction of Basic Service Demat Account (BSDA) by SEBI (Securities and Exchange Board of India), the annual maintenance charges structure will be on a slab basis. Here we provide you with information about BSDA.

- The basic services demat account promises to provide limited services at reduced costs to retail investors. These accounts are also called no-frills or basic demat accounts.

- An individual—who currently has a demat account or plans to open a demat account where he is the only first / sole holder—will be allowed to open the BSDA.

- The individual needs to ensure that the value of securities held in his basic trading account will not be more than Rs. 2 lakh at any given point of time.

- According to SEBI circular, all depository participants (DPs) will make basic trading accounts available with limited services and reduced costs. DPs’ will offer BSDA from 1 October 2012. Remember that you are allowed to open only one BSDA across all DPs.

As per SEBI directive, the charge structure will be based on value of holdings in the accounts as indicated below:

- No AMC shall be levied, if the value of holding is up to Rs. 50,000.

- For the value of holding from Rs 50,001 to Rs 200,000, AMC not exceeding Rs 100 may be charged.

- If the value of holding in such BSDA exceeds Rs. 200,000 at any date, the DPs may levy charges as applicable to regular accounts (non-BSDA) from that date onwards.

- SEBI has assigned DPs to determine the value of holding on the basis of the daily closing price or NAV (net asset value) of the securities or units of mutual funds.

- If the value of your holdings exceeds the slabs mentioned above, DP’s are permitted to charge you the same as they charge non-BSDA regular demat accounts.

You do not need to submit any request for converting your account into BSDA.

Its an automated process wherein DP verify all the accounts to convert them under BSDA on the date of the next billing cycle based on value of holding of securities in the account as on the last day of previous billing cycle (Financial Year).

SETTLEMENT CYCLE

- In trading, there is a fixed time period for the settlement of trades as per terms of contract. This time period is termed as Settlement Cycle.

- For equity trades: Currently all trades are settled on T+2 settlement cycle.

- For derivatives/currency/commodities: Currently all trades are being mark to market at the closing price of contract and mark to market requirement are settled at T+1.

- For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded.

There are three types of settlements:

- Rolling/Normal Settlement

- Trade-to-Trade Settlement

- Auction

A Settlement Cycle refers to a calendar according to which all purchase and sale transactions done on T Day are settled on a T+2 basis. T = Trading Day and +2 means 2 consecutive working days after T (excluding all holidays). It simply means that if the customer buys share on 3rd Sept 2012 = T, Then the transaction will be settled on 5th Sept 2012 = T+2. At NSE and BSE, trades in rolling settlement are settled on a T+2 basis i.e. on the 2nd working day.

- Trade to Trade settlement is a segment where shares can be traded only for delivery. It means Trade to Trade shares cannot be traded on intraday basis. Each share purchased /sold which is a part of this segment need to be taken delivery by paying full amount

- No intraday netting off/square off facility is permitted.

When the seller is unable to deliver the shares, the exchange initiate's an auction to purchase the required quantity of the same share in the auction market and give it to the buyer.

- In case an investor fails to deliver the shares sold in the Rolling Settlement, an auction is conducted of the quantity short delivered/ not delivered on T+2, to meet the obligation of delivery of shares to the buyer. In this auction session, offers are invited from fresh sellers for quantities short delivered.

- The Member through whom one has sold the shares is not allowed to offer shares in the scrip for which he has failed to make delivery.

- If the seller fails to deliver the shares, penalty will be charges by the Exchange.

- In case you place an intraday order; it has to be in the same exchange. You cannot buy the shares in NSE and sell in BSE.

- If you already have shares in Demat account; then you can sell in any exchange irrespective whether bought in NSE or BSE.

- 1% Auction settlement charges are levied on auction rate.

- In case of Market Auction, Auction rate are provided by Exchange and plus 1% Auction settlement charges is levied on the same.

- In case of Internal Auction, Auction rate are consider the buy rate of share bought and plus 1% Auction Settlement charges is levied on the same.

EQUITY SYSTEMATIC INVESTMENT PLAN (SIP)

Equity SIP is a new facility offered through starfinvest.in using which you can place buy orders for a prespecified amount or for a prespecified quantity in scrips of your choice at regular intervals over a period of time as selected by you. For instance, you can select an Equity SIP for a period of say 6 months to invest 3000 per month / other permitted frequency in shares of BHEL or alternatively you can choose to buy 1 shares of BHEL every month / other permitted frequency through Equity SIP.

After you have provided the necessary details i.e the scrip, amount / quantity to be invested, frequency of investment, total time period and authorized STAR FINVEST PVT LTD (SFPL) vide your Equity SIP request, SFPL will place your Equity SIP buy orders at market price.

Yes. All online existing and new clients of STAR FINVEST PVT LTD can avail the Equity SIP facility.

Equity SIP allows you to systematically invest a prespecified sum / buy a prespecified quantity of shares over any defined period of time in a disciplined manner. You can therefore invest at predefined intervals without the need to worry about the right time to invest in the Equity market.

Unlike in the cash segment, where you have to time the market to make gains, Equity SIP helps you to bring down your average cost of acquisition of shares due to the averaging principle.

Equity SIP eliminates the need for you to actively track the market and helps in distributing your investment over a period of time.

No. You can place SIP Requests for "buy" orders only under the Equity SIP facility.

Equity SIP request is an authorization given by you to SFPL for placing buy orders as per your instructions mentioned in the request.

The orders placed by SFPL as per your authorization vide the SIP request are called Equity SIP orders.

No. Equity SIP Request is merely an authorisation given to SFPL to place order in your account as per your instructions vide the SIP Request. Hence, funds are not required or used when you place Equity SIP Requests. Your funds would however be required and used at the time of placing the SIP orders.

Amount based Equity SIP is a SIP type wherein a fixed amount (or approximately the same) is invested in your desired scrip at each frequency.

In case of Amount based SIP, you need to specify the amount to be invested in the scrip at your desired frequency. The amount specified by you should be equal to or above the minimum amount defined by SFPL.

At the time of placement of your SIP order, since quantity of shares has to be specified, the same will be calculated by dividing the SIP amount specified by you with the prevailing market price of the scrip at the time of order placement as per the SIP request.

The formula would be Quantity = SIP Amount / Market price. Any fractional quantity will be ignored and order will be placed for the balance quantity. The actual order value would be based on the market price for the quantity so calculated above.

Quantity based Equity SIP is a SIP type wherein a fixed quantity of shares of your desired scrip is purchased at each frequency.

In case of Quantity based SIP, the quantity would be as specified by you and would be fixed while placement of orders as per your desired frequency. The order value would be calculated based on the market price of the scrip prevailing in the market at the time of order placement.

The "Equity SIP Registration Book" on the site is a page which displays the details of the SIP requests placed by you under the Equity SIP product. You can view the Equity SIP Registration book by visiting Equity SIP Registration Book link under the Holding page on the Equity segment. This book will provide you the details like the SIP reference no., stock name, quantity or amount, frequency, total period, start date, next SIP date, end date etc.

Equity SIP requests can be placed only in select scrips which are available on cash segment as per STAR FINVEST PVT LTD. SFPL may include or exclude any scrips from the Stock list at any time without any prior intimation.

All scrips which are available for trading in cash segment on STAR FINVEST PVT LTD platform are available for sip also. So, please refer equity market scrip list

You can place Equity SIP Requests for placing SIP orders in both NSE as well as BSE.

You can view your order placement date in the Equity SIP Registration book under the column 'Holding'.

Yes. Shares bought in your demat account through Equity SIP are at par with the ones bought by you in the cash segment. You can therefore sell/ otherwise deal in such shares at anytime as per your requirement

CORPORATE ACTION

- Corporate actions are actions taken by a company that impact the shareholders value directly. It is an event that brings material changes to a company and affects its stakeholders.

- These may be either monetary e.g. dividend, or non-monetary e.g. Bonus, rights, or stock splits.

The different types of corporate actions announced by a company are:

- Rights issue

- Dividend

- Stock Split

- Conversion of debentures into shares

- Amalgamation

- Merger

- Demerger

- Capital reduction / Consolidation of shares

- Buy Back

- Bonus

- Open Offer

Corporate actions are communicated to the shareholders by the Company. However, if you are not a shareholder, the corporate action details can be accessed from the NSE and BSE. You can visit below websites to get further details:

- www.nseindia.com » Enter Company Name» Click on Company Information

- www.bseindia.com » Enter Company Name» Click on Corporate Announcements

Yes, you can check the details from SFPL website. Please follow the below mentioned steps:

- Visit www.starfinvest.in

- Enter Company Name

- Click on Quick Links

- Click on Corporate Announcements.

When a company wants to raise capital, issue of fresh shares to the existing shareholders is one option available to the company. In such an issue, existing shareholders have the right to buy a specified number of new shares of the company at a specified price within a specified time. Usually this price is below the market price. The idea is to reward existing shareholders with an investment opportunity, which is perceived to be attractive.

Simply defined, Dividend is the portion of profit of a company, distributed to its shareholders.

- A company increases the number of shares that are outstanding by issuing more shares to existing shareholders. For example, in a 2-for-1 stock split, every shareholder holding one share is given an additional share. In such a case, the face value of the share is reduced (say from ` 10 to 5 per share).

- Companies stock's price is also affected by a stock split. After a split, the stock price of the company reduces since the number of outstanding shares increases, however the market capitalization remains the same.

- A consolidation is an Exchange of existing shares for a fewer number of the same share type with an increase in the nominal value per share maintaining the company’s overall share capital. This means that although your shareholding is reduced, you do not lose any value as the market price of the shares will increase accordingly.

- A company would issue a consolidation (reverse stock split) to increase the share price because they feel it would be more marketable at a higher price. The nominal value of each share is adjusted to maintain an equal total share capital as before the consolidation. The new shares are issued free of all charges to shareholders. On the effective date of the consolidation the price per share is adjusted to take into account the reduced number of shares in issue.

An amalgamation is the process by which two or more companies or legal persons merge into a single entity.

The combining of two or more companies, generally by offering the stockholders of one company securities in the acquiring company in Exchange for the surrender of their securities.

- Demergers are situations in which divisions or subsidiaries of parent companies are hived off into independent corporations.

- The process for a demerger can vary depending on the reasons behind the implementation of the split.

- Generally, the parent company maintains some degree of financial interest in the newly formed corporation, although that interest may not be enough to maintain control of the new corporate entity.

Offer by issuing company to existing shareholders to repurchase the company’s own shares or other securities convertible into shares. This results in a reduction in the number of outstanding shares.

A bonus share is a free share of stock given to current shareholders in a company, based upon the number of shares that the shareholder already owns. While the issue of bonus shares increases the total number of shares issued and owned, it does not change the market capitalization of the company.

- Acquirer offer to purchase particular company’s shares from existing shares holder at pre-decided price, accordingly public announcement & letter of offer issued to all existing shares holder wherein details of Escrow demat a/c mentioned in the same.

- Open offer is for particular period which is also mentioned in the letter of offer.

- Let us understand the meaning of different important dates for corporate actions:

This is the date on which the board of directors announces to shareholders and the market as a whole that the company will pay a dividend.

Ex Date:This is the date on which security trades without the benefit of Corporate Action .An investor buying security on or after the ex-date is not eligible for the Corporate Action by the Company.

Record Date:This is the date on which the company looks at its records to see who are the shareholders of the company entitled for the Corporate Action. An investor holding shares on record date will be eligible for the Corporate Action

Date of payment:his is the date on which the company mails out the Corporate Action to the holder of shares on the record date. This date is generally a week or more after record date so that the company has sufficient time to ensure that it accurately pays all those who are entitled.

- Below is the table which will tell on who is eligible for the corporate action:

| Before Ex Date | On Ex Date | After Ex Date | |

|---|---|---|---|

| Buyer | Eligible | Not eligible | Not eligible |

| Seller | Not eligible | Eligible | Eligible |

- Hence if you are holding shares in trading (pool)/demat account on or before record date irrespective of debit or credit balances in your trading or demat account; you are eligible for corporate benefits.

In derivatives segment, only lot size, price and/or strike price (as the case may be) of the scrip is changed by the Exchange. There is no corporate benefit received by customer in any form.

- Shares lying in demat account:

You will receive shares/ dividend/ bonus/ interest directly from the company's registrar into your bank account/ demat account or through cheque/ DD.

- Shares lying in trading/ pool account:

You will receive shares/ dividend/ bonus/ interest from broker where you hold a trading and a demat account.

An entity contracted to keep a record of the owners of stocks and bonds issued by the company.

- Visit www.nseindia.com » Enter Company Name» Click on Company Information» Company Contact Details

- Visit www.bseindia.com » Enter Company Name» Click on Corp Information

You will receive benefits directly from the company. You need to contact RTA of the company if shares/ credit/ interest are not received in your account.

- You will receive benefits through your broker where you have your demat and trading account.

- In case you have not received the benefits, you can call on 011-43070700 or write us at star@starfinvest.in

You can contact to the RTA of the Company.

DEMAT RELATED

A depository is an organization where the securities of an investor are held in electronic form, at the request of the investor through the medium of a Depository Participant.

A Depository Participant (DP) is an agent of the depository and is authorized to offer depository services to investors. According to SEBI guidelines, financial institutions, banks, custodians, stockbrokers, etc. can become DP with a depository.

- Central Depository Services (India) Limited (CDSL) Promoted by BSE, BOI, BOB, SBI and HDFC Bank

- National Securities Depository Limited (NSDL) Promoted by UTI, IDBI and NSE

The services performed by the Depository Participant are listed below:

- Account Opening & Maintenance

- Dematerialization of Securities & Mutual Funds

- Rematerialization of Securities & Mutual Funds

- Transfer of Securities & Mutual Funds

- Pledging / Unpledging / Invocation of Securities

- Freeze/ Un-Freeze account

- Account Modification

- Account Closure

- Activation of Ideas (For NSDL DP)

- Registration of RGESS (Form A) & Release of Stock from RGESS (Form B).

In case you purchase or sell the shares the same is credited or debited from your demat / Trading account T+2 settlements.

CM BP ID stands for Clearing Member Business Partner ID.

In case you have sold some shares then you need to ensure that the shares are transferred to your demat account or CM BP account before 9:30 am on pay-in day.

On the base of POA (Power of Attorney) given & Signed by client at the time of account opening or Separately, SFPL Can debit the shares from client’s demat account to settle the pay-in obligation.

Delivery Instruction Slip (DIS) is an instrument to get shares transferred electronically from one account to another within the same Depository or Inter-Depository.

- You can send the requests of transferring shares from one Demat account to another by filling Delivery Instruction Slip (DIS).

- You can submit the DIS at your nearest branch or to RM or send directly at the below mentioned address:

Submit the documents at the below address:

DP Department

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

Any transaction involving delivery of securities to a clearing corporation / Clearing House for sale of securities done on a stock exchange platform is termed as ‘On Market’ transaction.

Off Market transaction is one which is settled directly between two persons where Clearing Corporation / Clearing House is not involved.

- For issuance of a new Delivery Instruction Book, you need to submit a Physical copy the Signed DIS Requisition slips from the Existing DIS Booklets

- If the DIS is lost or stolen, you need to submit the DIS requisition form. Click here to download the form for NSDL.

- Submit the self-attested PAN card copy. Branch / RM have to put In-Person verification details.

You can submit the documents at your nearest branch or to RM or send directly at the below mentioned address:

DP Department

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

Securities held in a depository account can be pledged to avail of loan/credit facility. Pledge of securities in NSDL depository requires that both the borrower and the lender should have account within a same Depository either in NSDL .

- If you want to pledge your shares with the bank then you will have to make an agreement with the bank.

- After the agreement is done, an agreement number is mentioned in the Pledge Request Form which has to be sent to DP

- Pledgor and the Pledgee must have a beneficial account with the same depository as inter-depository pledge is presently not permitted

- DP department once verifies the request from their end & Initiate the Pledge creation. Then after Pledgee (Counterparty Account holder) requires Accept/Confirm the pledge creation on the basis of Generated Pledge Order no. to Complete the Pledged Transaction.

- Pledged shares remain in Pledgor’sdemat account under the Pledged status which was non transferrable till Pledged shares is closed/Released.

If the Pledge request is rejected then the same is intimated to you via e-mail / SMS.

Un-pledge of securities is release of securities from Pledgee on repayment of the loan/credits by the pledgor.

- If you want to un-pledge shares, you need to submit an Un-pledge Request Form to DP.

- DP will first check the pledge sequence number which is mentioned on the Un-pledge form & initiate the Pledge Closure request.

- If bank/ pledgee confirm the closure request vide pledge sequence number then those shares are unpledged in Pledgorsdemat account in free balance.

SFPL sends DP Transaction + Holding + Bill statement (monthly) to your registered email id.

Dematerialization is the process by which you can get physical share certificates converted into electronic balances.

You need to submit Dematerialization Request by sending a duly filled up Dematerialization Request Form (DRF) to the DP along with the certificates of securities to be dematerialized.

- You need to submit DRF which you will receive from either from nearest branch or from your RM.

- Physical share certificate is required or Latest Self attested Statement of Accounts if you want to dematerialize Mutual Funds.

- Transposition means to change the order of holders of the shares i.e. the first holder may become second holder or third holder and vice versa.

- So if name of the holders in demat account and physical form is not in order then transposition form must be filled.

- For E.g.: The securities held by A B & C can be dematerialized in an account opened in the combination of A C & B, B C & A, B A & C, C A & B, and C B & A by submitting a transposition form with the demat request form.

Transmission is the process by which securities of a deceased account holder are transferred to the account of the surviving joint holder(s)/nominee/legal heirs of the deceased account holder by Submission of Notarized death certificate along with the relevant legal documents.

- Click here to download NSDL Transposition form.

Rematerialization is the process by which you can get your electronic holdings converted into physical certificates.

Transfer of securities from an account in one depository to an account in another depository is termed as an inter-depository transfer.

- Ideas: This is a facility introduced by NSDL so that clients can view holdings and transaction directly on https://eservices.nsdl.com

You need to submit Rematerialization Request by sending a duly filled & singed by account holder (s) Re-materialization Request Form (RRF) to the DP on the below :-

To,

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

You can download the Re-materialization Request form (RRF) from the below link or coordinate with your Relationship Manager or branch for the Remat Request form. NSDL : Download Form

PASSWORD

- Click on Forgot Password » Enter the mandatory fields and click on "ok"

- You will receive the password on your registered mobile number immediately.

- On receipt of the password, you can login to the terminal and can change the password within 72 hours or else the same will be expired automatically.

- Note: Date of Birth is not the mandatory field in Forgot Password.

- Also, once you change the password, it expires after every 90 days.

- Alternatively, you can also reset the password by giving a miss call from your registered mobile with our records on 011-43070700

Yes. At the time of account opening, you need to sign the authorization letter for receiving password via SMS on registered mobile number.

- You need to submit the self attested Authorization Letter for Receiving Password over email. Click here to download the form.

- You need to scan the form and need to give four verifications on email to receive password via email through your registered email id.

- Send an email at helpdesk@starfinvest.in

- You need to submit the self attested Authorization Letter for Receiving Password over email. Click here to download the form.

- You need to scan the form and need to give four verifications on email to receive password via email through your registered email id.

- Send an email at helpdesk@starfinvest.in

Password expires every 90 days

The terminal will get unlocked automatically within 15 minutes. Subsequently, you can login to the terminal.

Yes. You can call the customer service number i.e. 011-43070700 and can give the request to unlock the account.

If you have logged in to a terminal on one PC and selected the option to bind on the same machine, you cannot login from another PC the next time. To unbind the same you can call the customer service number i.e. 011-43070700 and can give request to unbind your system.

In order to avoid the problem in future, whenever you Login to the TT terminal you need to select the ‘Remove Binding Option’ under Tools before you log out from the system.

MODIFICATION

Yes. You can change the mobile number / Email ID online

You can change the mobile number through online as well as offline mode

- If your registered email id is inactive/not accessible. We request you to follow the below mentioned process:

You need to submit self-attested Change in Account details form.Click here to download the form Submit the documents at the below address:

To,

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

- If you're registered email id is active. We request you to follow the below mentioned process:

1. Send an email from your registered email id at backoffice@starfinvest.in mentioning your old as well as new mobile number

Following documents can be submitted as address proof which should be self attested:

Passport should be valid for next 3 months

- Driving License should be valid for next 3 months

- Voter ID

- Ration card copy mentioning your current address on it

- Registered Leave & license agreement (should be valid atleast for next two months)/ Agreement of sale

- Electricity bills/ Telephone bills (not more than two months old)

- Self declaration of High Court & Supreme Court judges, giving the new address in respect of their own account

- Identity card/ document with address, issued by Central/ State Government and its departments, Statutory/Regulatory Authorities

- Bank Statement (not more than 3 months old) along with the cancelled cheque

We request you to follow the below mentioned steps to change the signature:

- You need to submit self attested Change of Signature form. Click here to download the form

- Self attested id proof is required

- The letter or account modification form containing the old signature and new signatures must be attested by the Bank of client which is registered/ updated in SFPL records

Submit the documents at the below address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

We request you to follow the below mentioned steps to change/update the nominee for CSDL account:

- Submit duly filled and signed by account holder(s) Nomination form.Click here to download the form

- Complete nominee details should be mentioned along with the demat account number

- Submit Identity Proof of Nominee (PAN with photograph mandatory).

- Submit Address Proof of Nominee

- You need to attach nominee's photograph signed across the photograph by nominee

Submit the documents at the below address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

- Note: Account holder cannot be the nominee

- A minor can be nominated. In that event, the name , Identity Proof (PAN card is mandatory) and address of the guardian of the minor nominee shall be provided by the beneficial owner.

- Copy of birth certificate of minor

- You need to submit the self attested Authorization Letter for Receiving Password over email. Click here to download the form.

- You need to scan the form and need to give four verifications on email to receive password via email through your registered email id.

- Send an email at support@starfinvest.in

- Running Account Authorization (RAA) is an authorization given by you to the Broker to maintain funds and securities in your account held with the Broker and not release the same within one working day of the payout from the Exchanges.

- Based on the RAA, Broker shall not release any funds and securities lying in your account with Broker Member and shall retain the same towards margin/ future obligations.

You can give RAA at the time of account opening or you can also give after the account gets opened.

RAA given by you would continue to be valid until it is revoked by you.

No. Giving RAA to the Broker is not a mandatory requirement. You have an option of not giving such RAA to the Broker.

- In case you have not provided RAA to the Broker, you are required to make payment towards the purchases made latest by T+2 working days.

- In case of sale transaction, payout towards the same shall be released to you within one working day of payout being received from the Exchanges, subject to margin, dues and charges payable by you to the Broker.

- In case you have given RAA, actual settlement of funds and securities is required to be done at least once in a quarter or once in a month as per the periodicity of settlement selected by you.

- You can thus, while giving RAA, select the periodicity of settlement which can be either 'Quarterly' or 'Monthly'.

- Based on the said authorization, settlement of funds and securities shall be made on monthly or quarterly basis.

- You can request for payout of funds at any point of time, subject to credit balance in your ledger account held with broker and adjustments of various margins, dues and charges.

- However, if the you have not requested for the payout even once during the Periodicity of Settlement, the Broker shall release the funds to your account by transfer to bank account through NEFT, once in a quarter or once in a month as per the periodicity of settlement opted by you subject to credit balance in your ledger account and adjustments of various margin, dues and charges as permitted by SEBI/ Exchanges.

- The first settlement shall be required to be made in the month/ quarter in which you have given RAA to the Broker.

- Eg.: In case the RAA is dated 15th Jan 2020 and the Periodicity of Settlement selected by you is 'Quarterly', the first settlement shall be required to be made latest by 31st March 2020.

- In the same e.g., if you have selected Monthly' as Periodicity of Settlement, first settlement shall be required to be made latest by 31st Jan 2020.

You should bring up any dispute arising from the statement of account or settlement so made to the notice of the Broker preferably within 7 working days from the date of receipt of funds/ securities or statement, as the case may be.

- You need to submit the self attested Running Account Authorisation form. Click here to download the form

Submit the form at the below mentioned address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

To ensure immediate redressal of queries certain immediate updations are done in the trading account on the basis of the soft copy and in the demat account only after receipt of the hard copy. Updations in the trading account which are made on the basis of scanned copies are as below:

- Contact number change/ addition

- Email id change

- IFSC code updation

- Authorization letter updation for sending password through email

- Bank addition.

- You are intimated through a letter only for changes done in demat account.

- For rest of the updation in trading account, intimation is sent through SMS on registered mobile number & Email on registered email id.

- In order to ensure funds and securities settlement with trading member, customer is required to link bank and demat account.

- Linked bank and demat account signify that broker can accept / transfer funds/securities only from these mentioned account from / to the customer.

Yes, you can give instruction to add/change linked/registered bank account.

Yes, you can opt for multiple banks / demat account by submitting written request and relevant supporting documents.

Yes, you can opt for multiple registration of bank account with your trading account and during payout you can select any one of the registered bank account.

You can link 3-4 savings bank accounts.

- Please note that this bank will not be considered as default bank for funds payout purpose.

- If your registered email id is active, follow the below mentioned steps to add the new bank account:

- We request you to send an email from your registered email at star@starfinvest.in and send the following scanned documents:

- Scanned self attested Change in Bank details form. Click here to download the form.

- Scanned copy of cheque where the name(s) of the account holder(s) should be printed.

- If the name(s) of the account holder(s) is not printed then self attested Bank Statement or passbook updated till last three months along with cancelled cheque should be submitted.

- If your registered email id is inactive/not accessible:

- We request you to submit the following documents:

- Self attested Change in Bank details form. Click here to download the form

- Copy of cheque where the name(s) of the account holder(s) should be printe

- If the name(s) of the account holder(s) is not printed then self attested Bank Statement or passbook updated till last three months along with cancelled cheque should be submitted.

Submit the documents at the below address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

We request you to submit the following documents:

- Self attested Change in Bank details form. Click here to download the form

- Copy of cheque where the name(s) of the account holder(s) should be printed

- If the name(s) of the account holder(s) is not printed then self attested Bank Statement or passbook updated till last three months along with cancelled cheque should be submitted.

Submit the documents at the below address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

Note:If you opt to change the bank details, new bank details will be updated as default for all transactions and if you opt for addition of bank details the same will only be added in your account and will not be marked as default for future transactions.

- Yes you can submit the documents to your Relationship Manager

- All documents should have stamp of "Verified with original" and need to have signature of RM or Branch Manager.

No you cannot delete the bank account from your trading account.

We require the following documents to change/add the new demat account:

a. Written application duly signed by all the holders of the account

b. Client Master List of the DP to be linked.

No. You cannot as we require cancelled cheque to update the IFSC code.

- No. We require separate form to change/add the bank details for Equity and Commodity.

- Click here to download the Change in Bank details form for Commodity

You cannot update only the bank account number. You need to change the bank account.

You cannot update only MICR code. You need to change the bank account to update the MICR code.

Authorized person should be Spouse, dependent children and dependent parents only

Authorize person can Place / Give Instruction for Trade, Request Payout, Receive & Acknowledge all the documents including Contract Note, Statement of Accounts, Holding Statements, Quarterly Statements etc...

- Submit duly filled and signed "Authorisation to Place Instructions". Click here to download the form.

- Self attested PAN card copy is required

- Self attested address proof is required

Submit the documents at the below address:

Star FinvestPvt Ltd

311 Aruanchal Building,

19 Barakhamba Road, New Delhi – 110001

No. You cannot update International number in Individual Resident Account.

Star Finvest Pvt.Ltd

NEW DELHI:

Corporate / Reg Office

3rd Floor, 311-316 Arunachal Building, 19 Barakhamba Road, New Delhi - 110001

GET DIRECTIONUTTAR PRADESH:

Ghaziabad Branch

Yamnotri Complex, Office No A 12, Ambedkar Rd, Ghaziabad, Uttar Pradesh - 201001

GET DIRECTIONAs you are aware, under the rapidly evolving dynamics of financial markets, it is crucial for investors to remain updated and well-informed about various aspects of investing in securities market. In this connection, please find a link to the BSE Investor Protection Fund website where you will find some useful educative material in the form of text and videos, so as to become an informed investor.

https://www.bseipf.com/investors_education.html

We believe that an educated investor is a protected investor !!!

SEBI Regn Nos.

NSE CASH INZ 000160735. NSE F&O INZ 000160735. BSE CASH INZ 000160735. BSE F&O INZ 000160735 DP (NSDL) IN-DP-268-2016. MCX INZ 000160735.DISCLAIMER

"Investment in securities market are subject to market risks, read all the related documents carefully before investing."Designed , Developed & Content Powered by ●●● Accord Fintech Pvt. Ltd.

Filing complaints on SEBI Complaint Redress System (SCORES) - Easy & quick

-

Register on SCORES portal

-

Mandatory details for filing complaints on SCORES:

Name, PAN, Address, Mobile Number, E-mail ID.

-

Benefits:

Effective communication

Speedy redressal of the grievances.

You can file complaints on SCORES through https://scores.sebi.gov.in/